Fast-track your acting aspirations with our user-friendly resume templates,

helping you create a standout resume in just 15 minutes!

The next generation of Resume Templates

Get Started

The next generation of Resume Templates

Get Started

Feeling trapped in a job that doesn't align with your passion for the movie industry? It's time to break free from the monotony and pursue your true calling. Don't let your talents go unnoticed any longer. Discover how our actor resume templates can help you escape the wrong job and transition into a fulfilling career in the world of movies. With our expertly designed templates, you can confidently showcase your skills, experiences, and aspirations, putting yourself on the path to success in the movie field.

In a competitive job market, proving yourself as the perfect candidate is essential. We understand the unique requirements of the movie industry, and our actor resume templates are specifically tailored to help you stand out from the crowd. With our templates, you can highlight your acting abilities, showcase your training and accomplishments, and demonstrate your passion for the craft. Whether you're a seasoned actor or just starting your journey, our templates provide the foundation for presenting yourself as the ideal candidate to casting directors and industry professionals.

In the world of movies, making a strong impression is crucial. Our actor resume templates enable you to showcase your best side and make a lasting impact. With their professionally designed layouts, eye-catching formats, and customizable sections, our templates empower you to present your skills, talents, and unique qualities with confidence. From headshots to project highlights, our templates provide a comprehensive framework for capturing the attention of decision-makers and showcasing your potential as an exceptional actor in the movie industry.

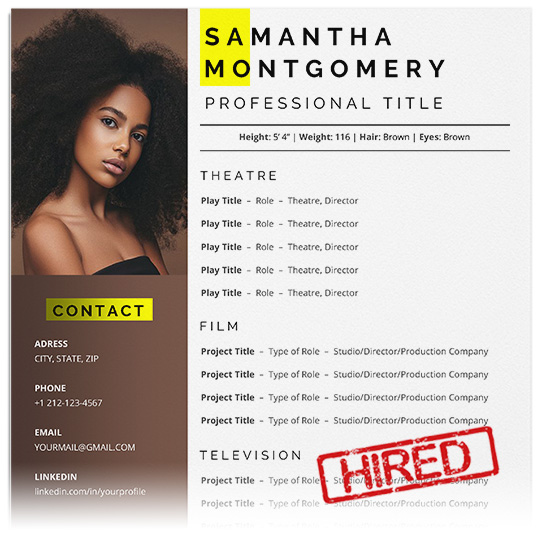

The Newcomer's Canvas: Dive into the world of acting with this blank canvas of opportunity. This acting resume template is perfect for beginner actresses looking to embark on their creative journey. Its simple yet elegant design provides ample space for you to highlight your training, skills, and any performances you've been part of. Let this template be the starting point for your artistic exploration.

Buy Creative Acting Resume Template

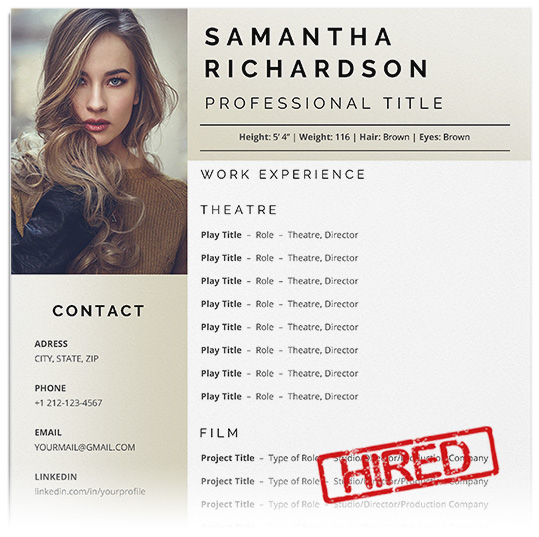

The Talent Showcase: Stand tall and shine bright with this acting resume template that is specifically crafted to highlight your unique talents. Its clean and professional layout ensures that casting directors can easily navigate through your qualifications, including your acting classes, special skills, and previous experience. Whether you've appeared in community theater productions or student films, this template will help you present your achievements with confidence.

Buy Top Acting Resume Template

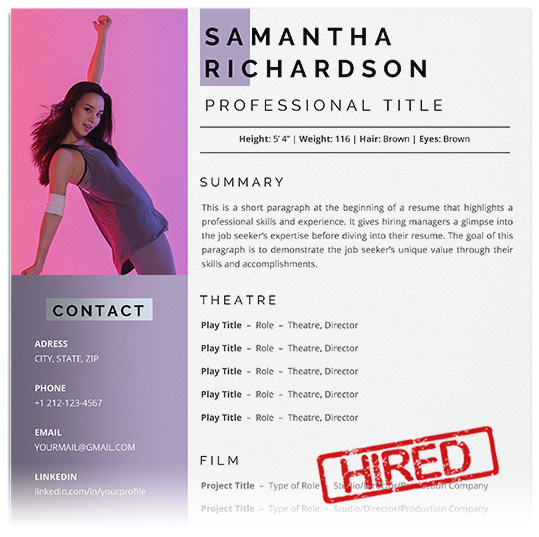

The Rising Star: As a budding actress, you deserve a resume template that captures your potential. This template, with its sleek and contemporary design, is tailored to showcase your talent and ambition. Use it to outline your acting education, relevant workshops, and any performances you've given, leaving casting directors eager to witness your rise to stardom.

Buy Modern Actress Resume Template

The Character Chameleon: Unleash your versatility with this dynamic acting resume template. Its customizable sections allow you to present your skills across different acting styles, ranging from classical theater to improv comedy. With dedicated spaces to highlight your physical attributes, vocal range, and special skills, this template is the perfect tool to showcase your ability to transform into various characters.

Buy Actress Resume Template

The Drama Queen's Delight: Channel your passion for dramatic performances with this striking acting resume template. Its bold colors and theatrical elements make a statement, reflecting your dedication to the craft. Use this template to outline your training, theatrical roles, and notable achievements, leaving a lasting impression on casting directors seeking performers who can bring depth and intensity to their productions.

Buy Actor Resume Template

The Comedic Diva: If your comedic timing is your secret weapon, this acting resume template is tailored just for you. Its playful design and vibrant colors exude humor and energy. Use this template to highlight your improvisation skills, comedy performances, and any comedic training you've undertaken. Let your resume showcase your ability to bring laughter and joy to the stage.

Buy Dance Resume Template

The Spotlight Trailblazer: Forge your own path in the acting industry with this trailblazing resume template. Its modern design and dynamic layout convey your forward-thinking attitude and determination. Stand out from the crowd and show casting directors that you're ready to break barriers and make your mark.

Buy Acting Resume Template

A Resume Templates for Word is the easiest way to build a professional resume.

Downloads

Active Users

Review